More people are moving to Latin America these days, for a variety of reasons. Some are older Americans trying to stretch their retirement dollar. Some are younger families moving to a new country so they can raise their kids closer to nature. Others are starting an entrepreneurial venture overseas. One important consideration when moving abroad is getting adequate health insurance and evacuation insurance. It will give you peace of mind knowing that in an emergency you can go home, or to a nearby center of excellence to seek medical care.

Your US health insurance probably won’t cover you if you’re living in a foreign country.

Traditional insurers do not offer medical insurance in foreign countries. In addition, they are seldom portable, meaning you’re not covered for treatment outside the country. Some US carriers are not even portable from state to state. You need international health insurance instead, and there are many different carriers available to suit your needs. Let’s take a look at some quotes from a few of them that I prepared as examples.

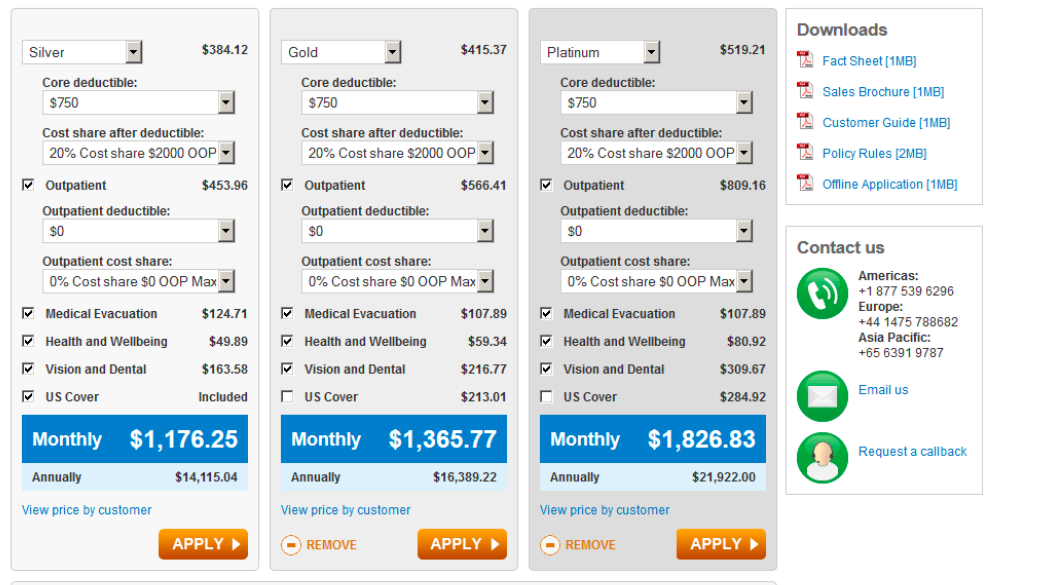

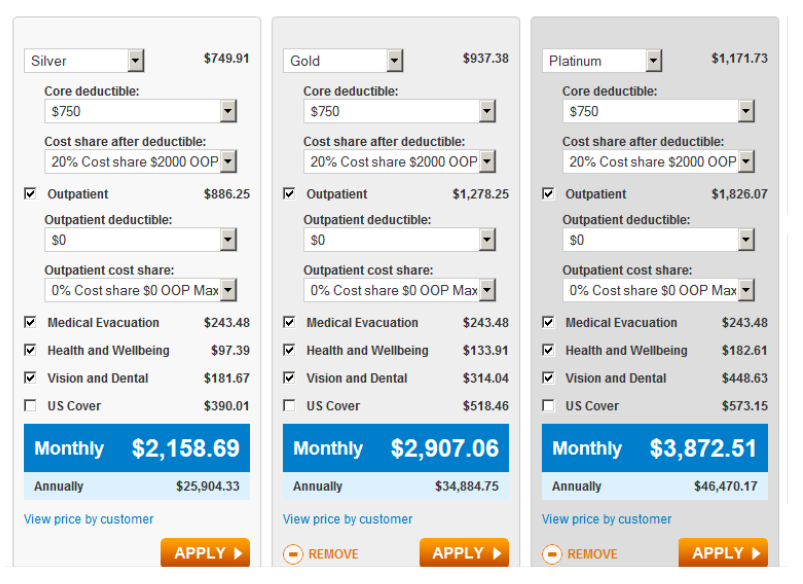

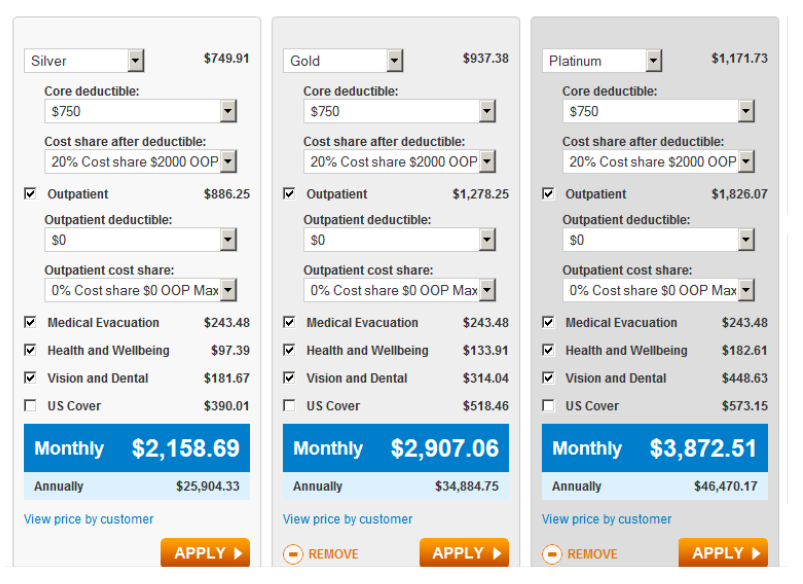

Example 1: Family of 4 from the U.S., including U.S. coverage Ages: 45, 40, 13 & 10 / U.S. citizens

With this plan for a family of 4, they can return the U.S. for up to 3 months at a time to visit family, tend to business, or visit their doctor.

As you can see, this quote is easily modified. As quoted above, it has a low deductible and a zero deductible for inpatient care. Many clients drop the outpatient care altogether and pay out of pocket for minor treatment. They opt for a higher deductible and have coverage only for inpatient emergencies and major treatment. U.S. coverage is of course only needed if they plan to visit or seek medical care in the U.S. U.S. coverage is limited to a total of 3 months for U.S. citizens, but unlimited for citizens of other countries. This option is usually a good value for a European or even a Latin American family that wants access to U.S. medical services that are only a short plane ride away.

Click here to review or purchase the Cigna Global Benefits Plan.

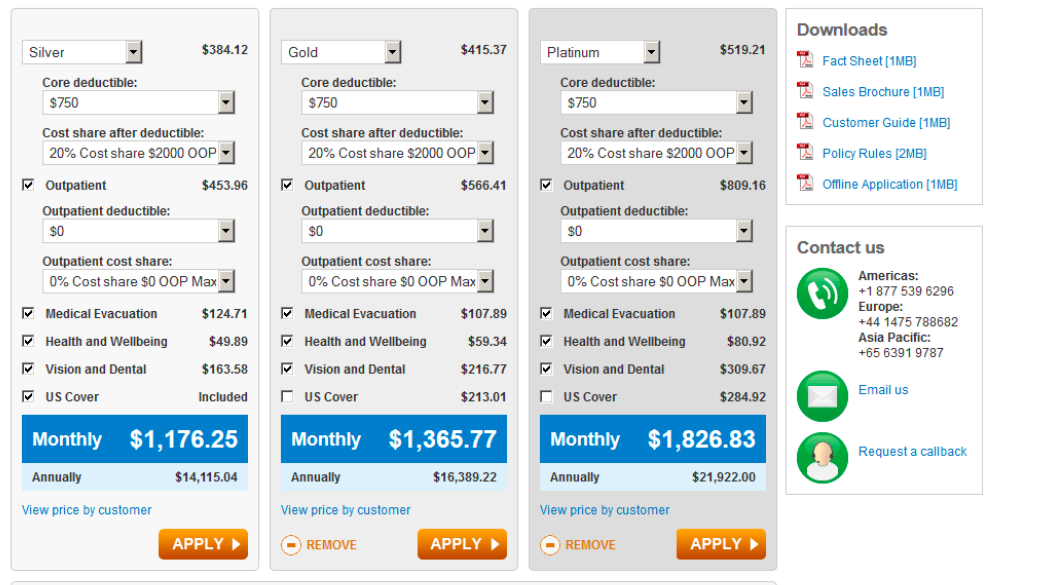

Example 2: A couple enjoying early retirement, no U.S. coverage

Ages: 53 & 50, French citizens

This couple doesn’t need U.S. coverage. Most Europeans are more likely to seek medical care in Mexico or back home. However, if you look at the quote form carefully, you will see that U.S. coverage can be added on. Unfortunately, doing so doubles the price. Medical care in the U.S. is very expensive, although costs can again be reduced by increasing the deductible, especially for inpatient care. You will also see a reduction by increasing cost sharing.

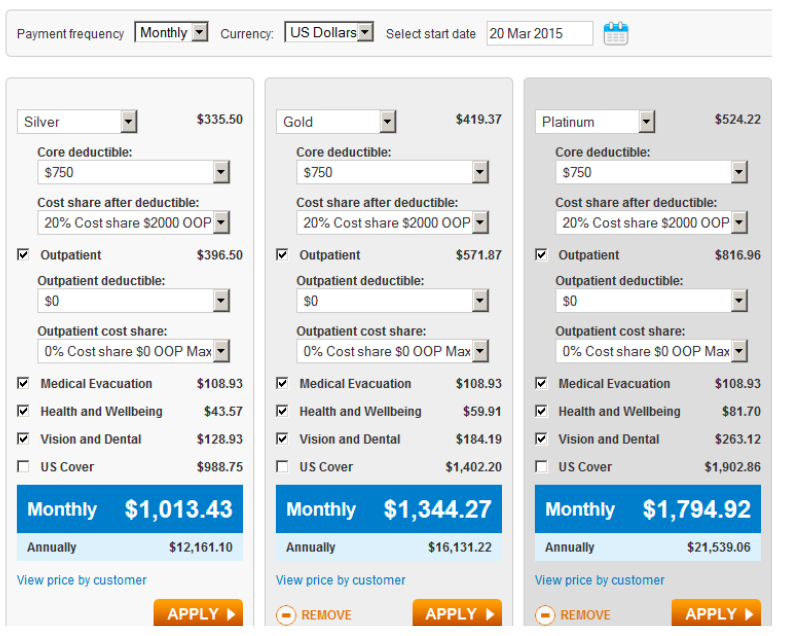

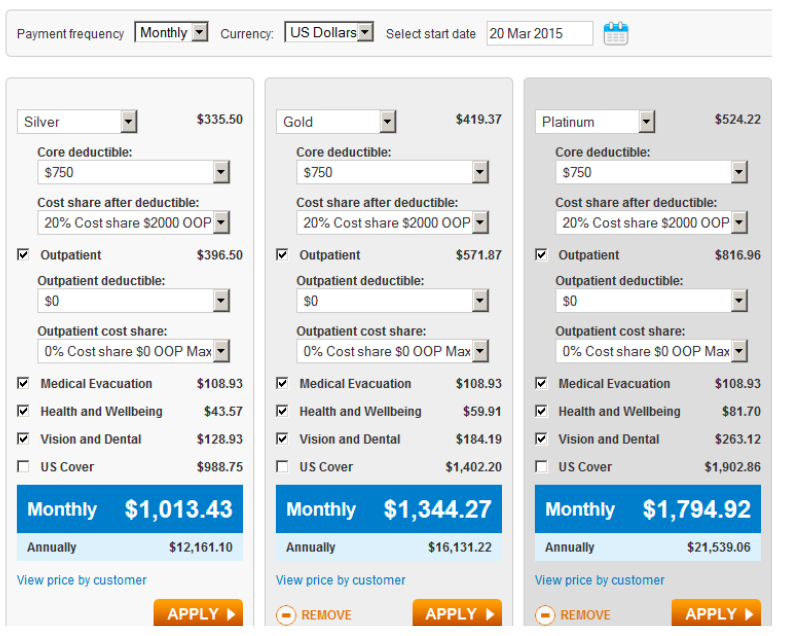

Example 3: Older retired couple, no U.S. coverage

Ages: 60 & 70, U.S. citizens

This couple didn’t include U.S. coverage because at this age they typically get Medicare coverage for treatment when they go home. Once again, costs can be reduced by almost half if they eliminate outpatient care and pay for minor treatment out of pocket. They can use their insurance in the event of a major emergency, such as a heart attack or stroke, or a cancer diagnosis.

Cigna Global not only has the advantage of a giant network of providers, it is also the largest global provider of health insurance and well known throughout the world. They are also more likely to pay directly to the provider. That means you wont be left paying the bill and later filing for reimbursement. While Cigna is my personal favorite, their premium insurance can be out of the price range for some expats.

There are other companies you can consider.

Let’s take a look at two other companies that have similar plans, strategies and prices, IMG and Seven Corners. Both are underwritten by Lloyds of London for the majority of their plans and follow the reimbursement model. That means you pay out of pocket for most medical expenses and then file a claim to get reimbursed. IMG has been around a long time, and Seven Corners has the distinction of being the insurer of the Peace Corps.

Although their plans are often less expensive, the drawback to these companies is they are more selective about pre-existing conditions. This means they are more likely to issue “exclusionary riders” to exclude previous medical conditions that you have experienced. That being said, they have an excellent track record for getting people to safety. They are known for helping people get the medical care they need in difficult situations — from jungle evacuations to evacuations from your sailboat while cruising. Both IMG and Seven Corners have very popular plans because of their affordability.

Let’s take a look at our same three groups of people.

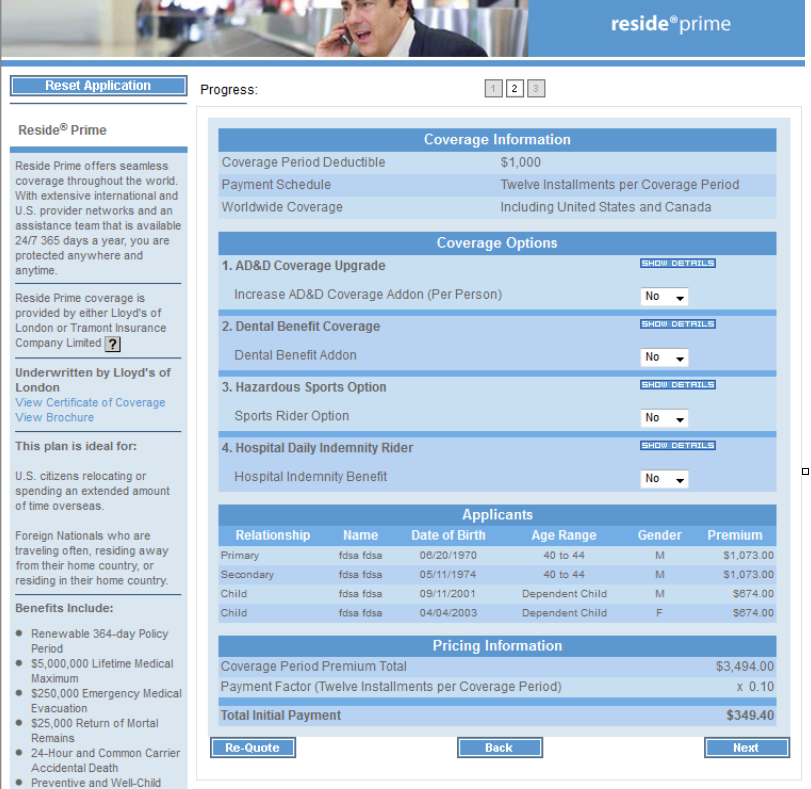

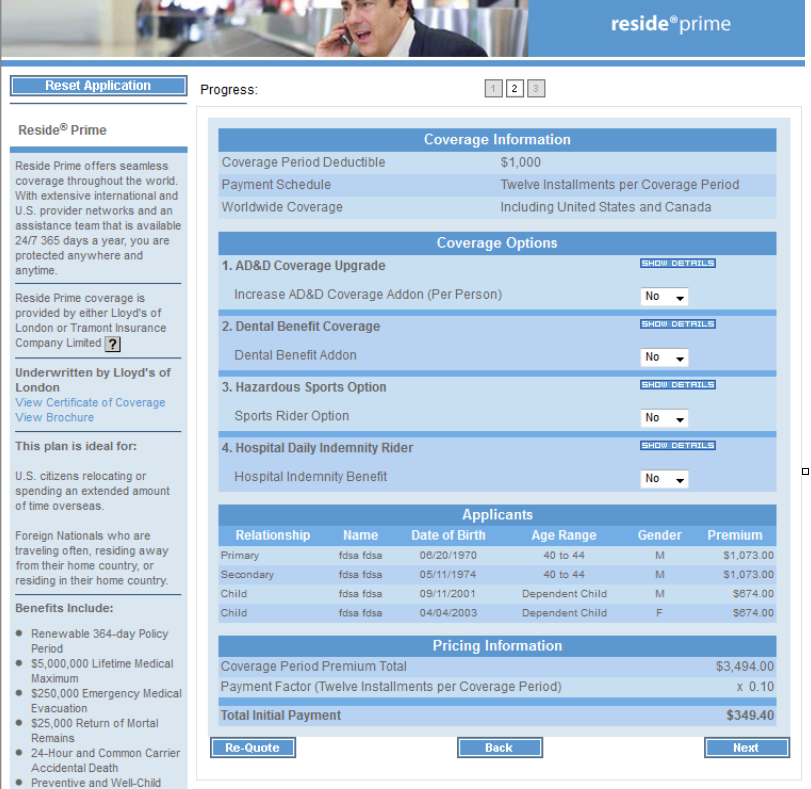

Let’s compare the family of 4 again:

With a Seven Corners plan, our family of 4 gets up to 6 months of U.S. coverage and a $1,000 deductible for only $349/mo. Drop that deductible to $250 and it’s still an affordable $500/mo. Adding dental (previous plan examples also included dental) would bring it up to around $650/mo.

Click here to review and purchase a Seven Corners Plan.

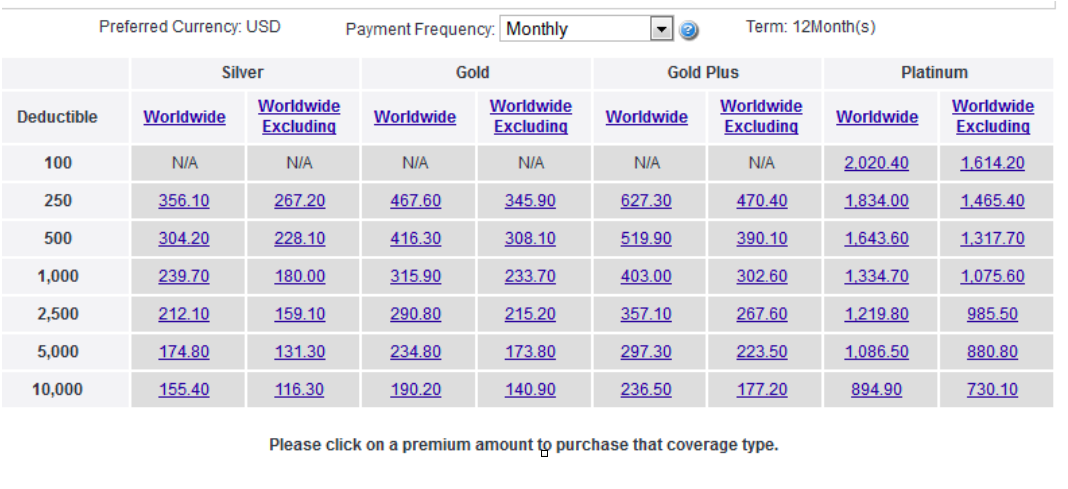

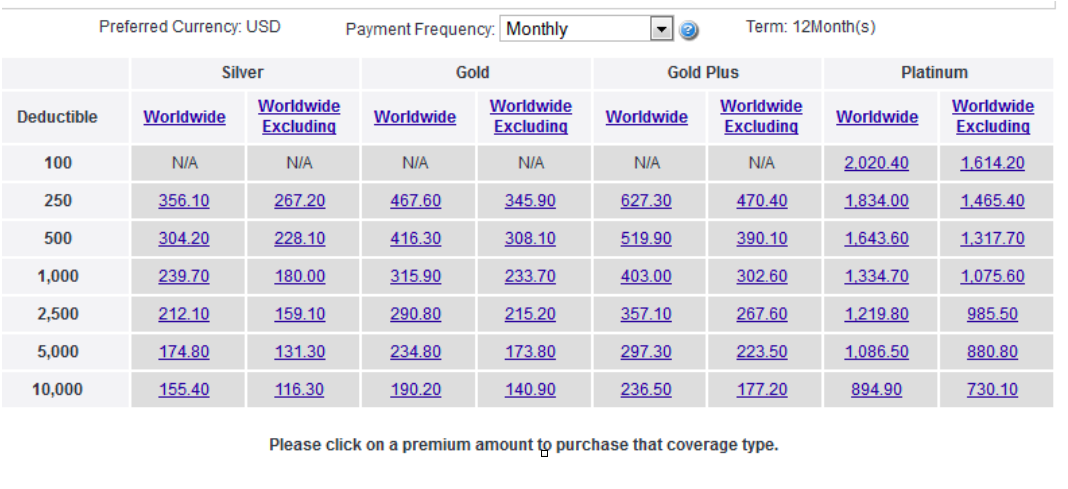

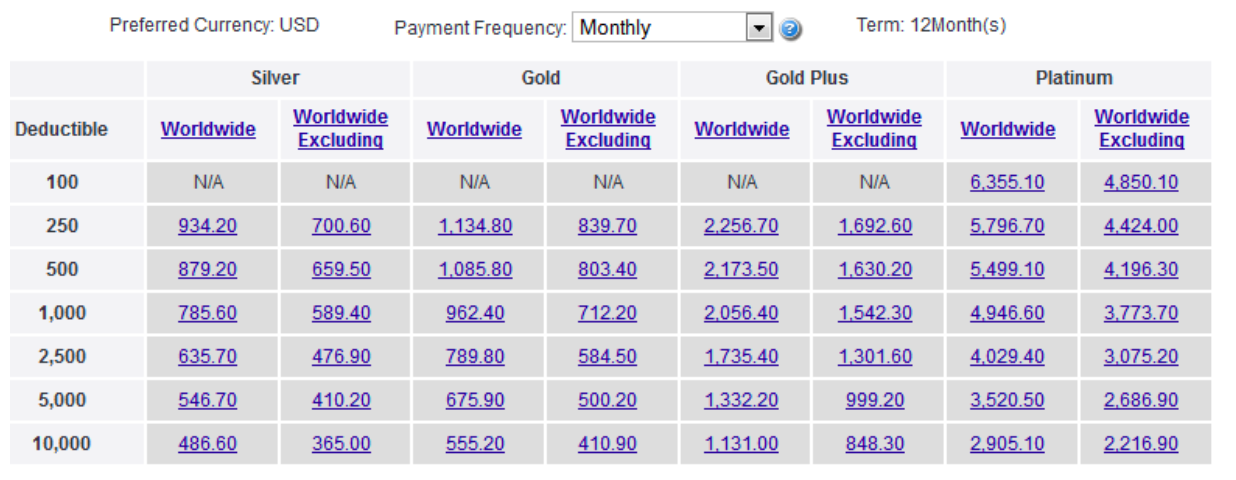

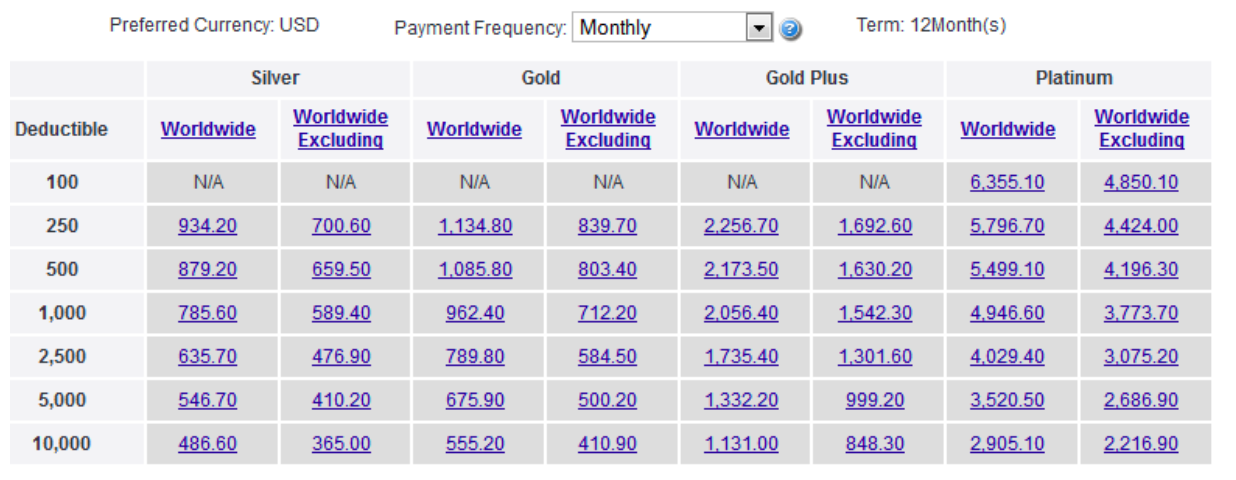

IMG has a wider range of options, starting with their basic Silver plan and ranging up to the Platinum plan which will cover all pre-existing conditions. (Keep in mind that pre-existing condition coverage is always contingent upon underwriting approval.) As you can see, IMG also has many deductible options that will change your cost. By the way, if you are a SCUBA diver, make sure you pick a Gold plan or higher. The benefits of both plans are similar.

Click here to review and purchase an IMG plan.

Let’s look again at our French retirees:

For similar benefits with Seven Corners: $264/mo. with a $1,000 deductible; $360/mo. with a $250 deductible.

The IMG Silver quote looks very comparable. I could compare the Seven Corners plan to IMG Gold, but it’s best to compare benefits side by side before making a decision.

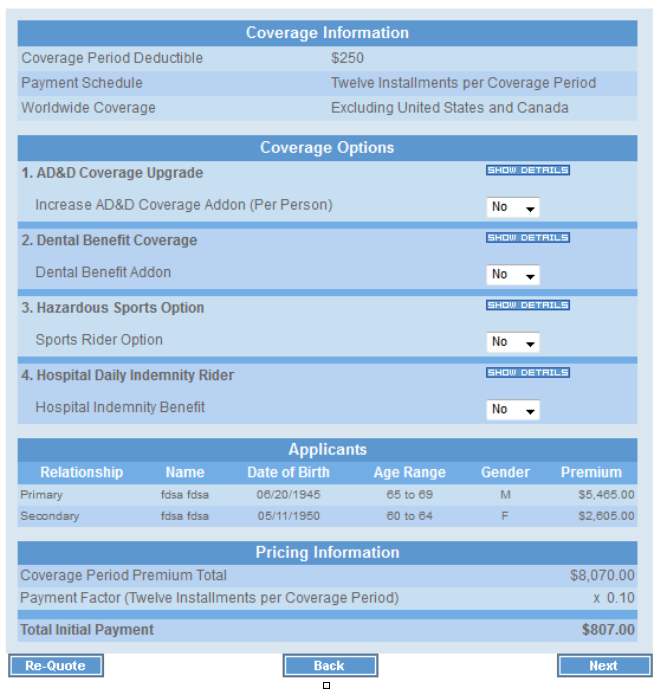

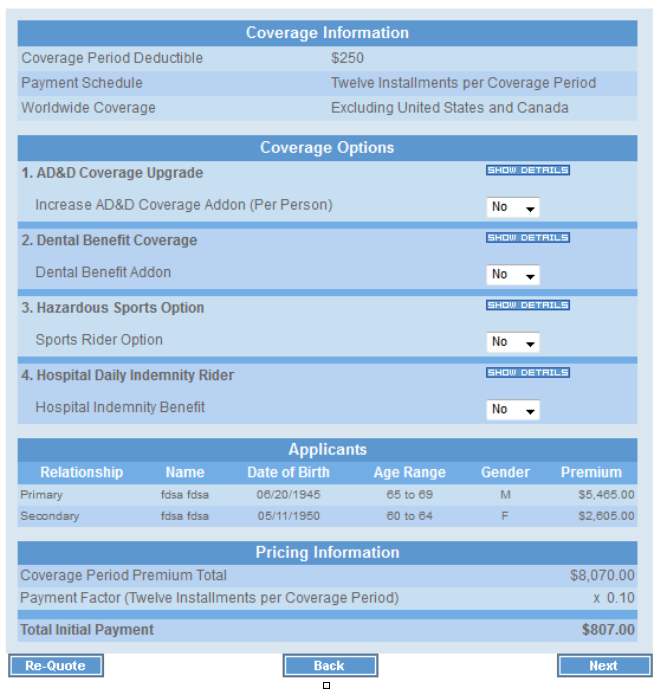

Finally, let’s see what the quotes look like for our older American retirees:

Seven Corners: $807/mo. with a $250 deductible. It drops to $680/mo. with a $1,000 deductible. Higher deductibles are also available, up to $5,000.

Once again, the IMG prices are very similar.

All of the above plans are paid monthly, but are annually renewable. IMG and Seven Corners give a 10% discount for paying the whole year up front.

Think you don’t really need expat health insurance? Think again.

You don’t need it…until you need it. Some people are able to go a long time without any medical coverage, and they do just fine. They’re the lucky ones. Then again, some people never buy homeowners or car insurance either.

I think we all know that as we get older our bodies begin to fail us on certain levels — an old football injury now needing surgery, a car accident leaving us debilitated, or those genetics we inherited that lead to heart disease or cancer. No matter how hard we try to take care of ourselves, everyone needs a doctor eventually. If you don’t have access to high-quality medical care where you’re living, you are going to want to find it somewhere else. Someplace where the doctors are certified, or speak your language, or perhaps just where you have family living nearby. While I know insurance is expensive, it is a small price to pay for the peace of mind that it provides when living in a foreign country. All of the insurance companies I work with cover clients worldwide and provide the best benefits on the market. I encourage every expat to carry some kind of international health and evacuation insurance.